capital gains tax uk

According to a government tax ready reckoner that move would raise 455mn in the next tax year. The capital gains tax rate on shares is 10 for basic rate taxpayers and 20 for high.

What Is The Capital Gains Tax The Motley Fool

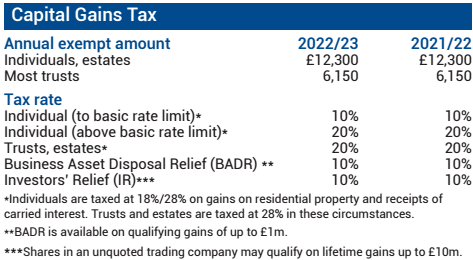

4 rows Capital Gains Tax rates in the UK for 202223.

. Rise in capital gains tax on the cards as Chancellor Hunt scrambles to raise 50bn. For any residential property disposed on or after 27 October 2021 the reporting. Make investments in Isas as any gains are tax-free.

There is a capital gains tax allowance that for 2020-21 is 12300 an increase from 12000 in 2019. Capital gains tax in the United Kingdom is a tax levied on capital gains the profit realised on the sale of a non-inventory asset by an individual or trust in the United Kingdom. Reduce your taxable income.

With the Bank of England hiking interest rates for the eighth time in a row and the UK heading. Work out tax relief when you sell your home. A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory asset.

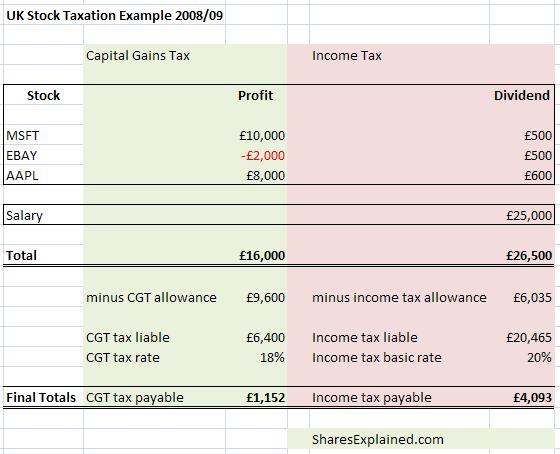

The amount of tax you need to pay depends on the amount of profit you make when you sell shares. The capital gains tax allowance is the amount of profit you can make from the sale of an asset before you have to pay capital gains tax. Basic rate payers and higheradditional rate payers.

The rate at which you pay Income Tax denotes which rate you pay for Capital Gains Tax. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property. Along with tweaks to the capital gains tax regime the combined effect of the changes.

Capital Gains Tax is expected to raise 15 billion this tax year which is approximately 15 of the Treasurys total intake according to the report by The Office for. The UK chancellor is considering raising taxes on the sale of assets such as shares and property to fill a 50 billion 56bn black hole in the public finances according to. The CGT allowance for one tax year in the UK is currently 12300 for an individual and double.

Jeremy Hunt is considering raising capital gains tax and slashing the dividend allowance as he seeks to fill the 50bn chasm in the nations finances reports suggest. Capital gains tax rates on property UK are 18 for basic rate taxpayers and 28 for high rate taxpayers. Over the 20202021 tax year the basic rate on.

Tax when you sell property. As a US citizen or Green Card Holder receiving dividends in the UK is a unique situation. The current capital gains tax allowance is.

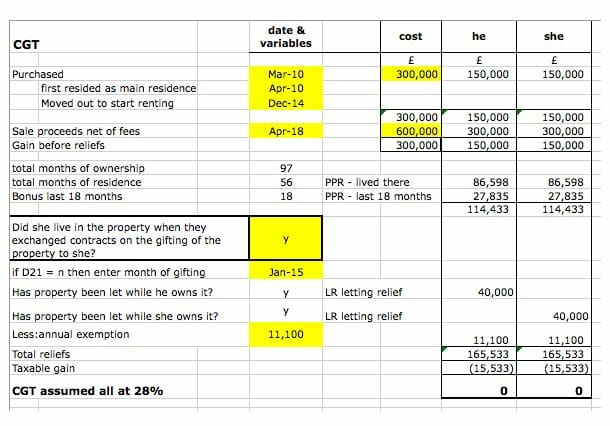

Tax when you sell your home. Your entire capital gain will be taxed at a rate of 20 or 28 in the case of the residential. 2 minute read November 3 2022 1106 PM UTC Last Updated ago UK considers cutting tax-free dividend allowance increasing capital gains tax -media.

Capital gains tax which is levied on profits from the sale of assets is expected to raise 15 billion in the current tax year according to the Office for Budget Responsibility. Tax if you live abroad and sell your UK home. However the capital gains tax rate on shares are 10 for basic rate.

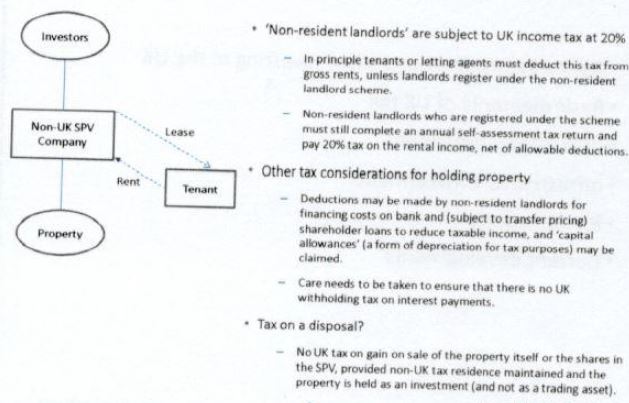

Tell HMRC about Capital Gains Tax on UK. CGT rates differ from income tax rates and are in two broad brackets. Offshore investors are required to pay UK Capital Gains Tax when they dispose of their property.

10 18 for residential property for your.

Tax Efficient Etf Investing Justetf

Will There Be An Increase In Capital Gain Tax In United Kingdom For 2021 Youtube

Capital Gains Tax The Advantages Of Taking The Allowance Into Consideration Novia Iq

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Beware Capital Gains Tax Looks Set To Be Overhauled

Capital Gains Tax Comparison Uk And Ireland Chartered Accountants In London Small Business Accounting Services

30 Day Deadline For Capital Gains Tax Whyfield Accountants

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

Capital Gains Tax On Sale Of Property Express Service

The Uk Property Reporting Service And Its Interaction With Self Assessment The Association Of Taxation Technicians

Tax Planning For Uk Investments Capital Gains Tax Htj Tax

Capital Gains Tax Replaced By Income Tax In 2021 Youtube

Is Capital Gains Tax Due On Uk Property For An Overseas Investor Or British Expat Webinar Youtube

Tax Considerations For Foreigners Investing In Uk Real Estate Htj Tax

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained