how are rsus taxed in the uk

Some companies choose to settle RSUs ie deliver the shares to the holder at the time of each vesting event but other companies may separate the two events. You will also pay national insurance at 2.

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

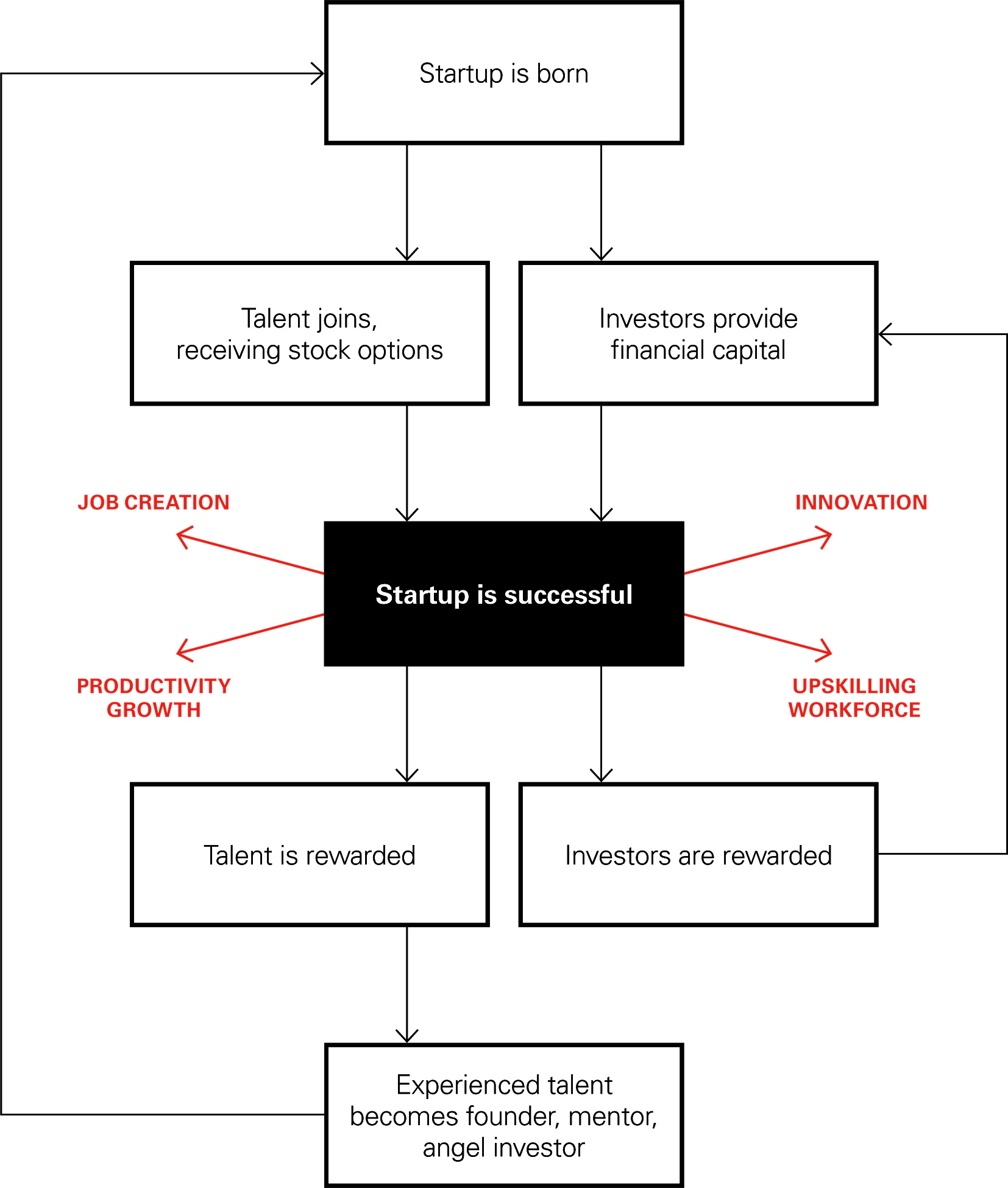

Employee owned trusts own controlling stakes in businesses on behalf of employees.

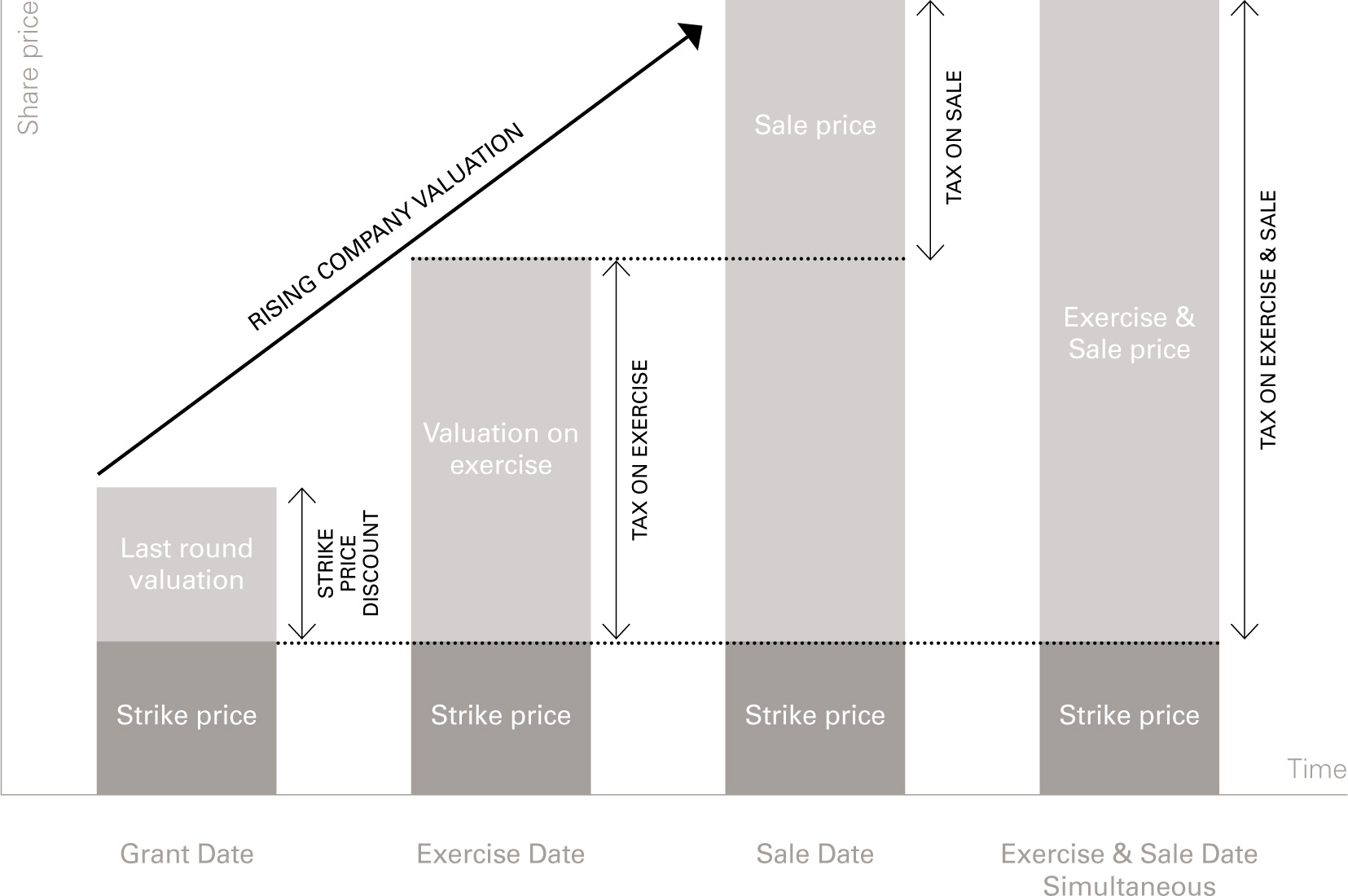

. Like other options schemes RSUs can be conditional and are subject to a vesting schedule. Their accumulated contributions are used to buy company shares at. The main thing to know about RSUs and taxes is that you pay ordinary income tax when your shares settle.

When your RSUs vest you will pay income tax and employee national insurance. You can save tax and national insurance by sacrificing your bonus into your pension. An ESPP employee stock purchase plan is an employee ownership plan that allows participants to purchase stock in their companies at a discount often between 5-15 off the fair market value FMVThe way they do this is by making contributions directly from employees paychecks.

For example if you earn 100000 and receive a bonus of 12000 the bonus will be taxed at 60. You may also need to pay for employers national insurance. Stock appreciation rights are taxed and deductible in substantially the same manner as non-statutory stock options.

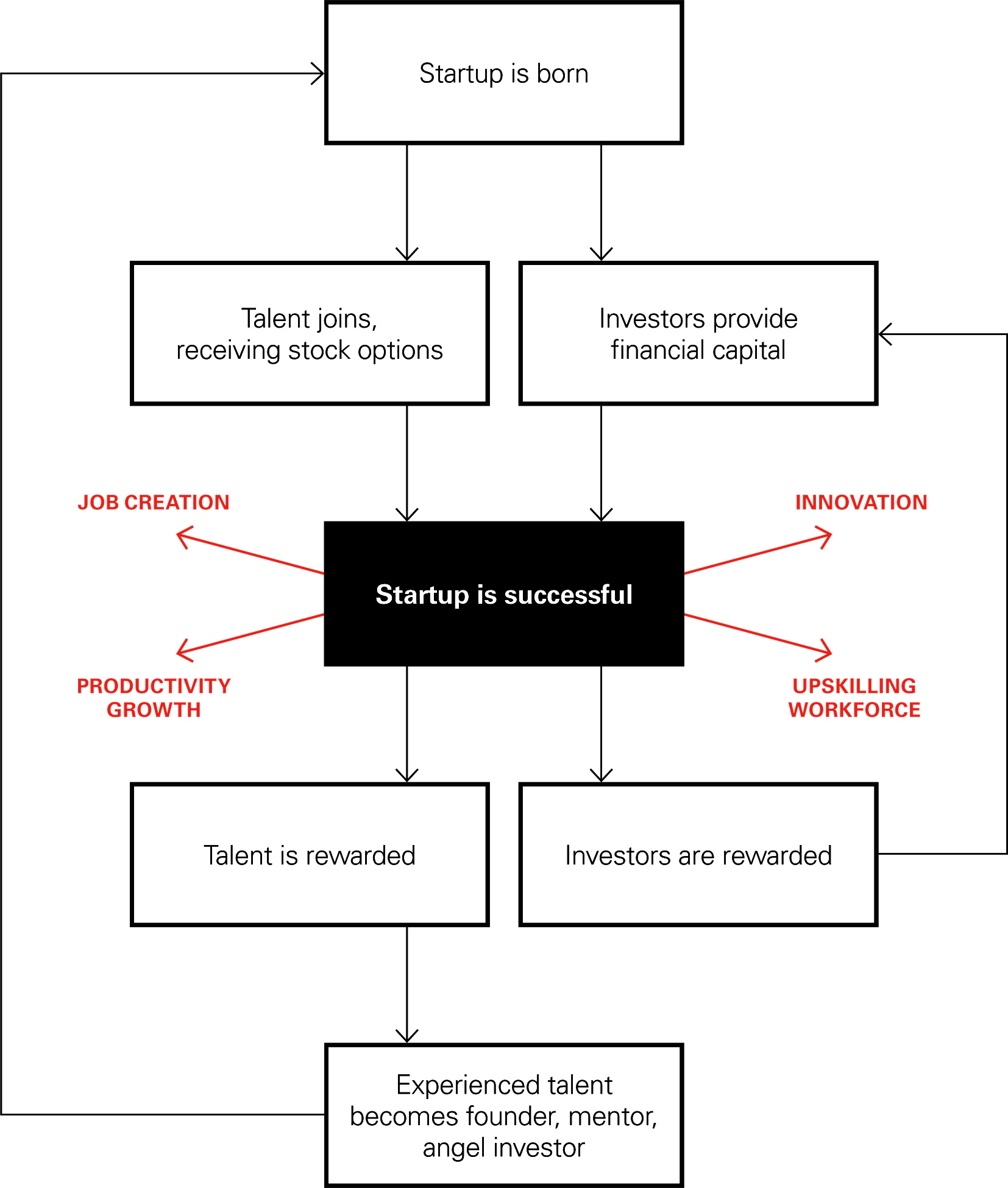

In the example above RSUs were granted when the FMV was 10 per share. The RSUs will vest over three years with one-third vesting on the first anniversary of the date our Board approves the grant of RSUs to Mr. You only pay tax on RSUs when they vest.

W Wayfair Inc Proxy Statement definitive def 14a We are pleased to continue utilizing the Securities and Exchange Commission or SEC rules that allow issuers to furnish proxy materials to their stockholders on the InternetOn or about August 29 2022 we will mail to our stockholders of record as of August 22 2022 other than those who previously requested. RSUs are another way of issuing equity. They can be structured rather like options but shareholders are taxed when the shares vest.

In all cases there is no tax to pay when RSUs are granted. They were introduced in 2014 as an. Jackson and in equal quarterly installments thereafter.

For more information check out this article on how to save tax with bonus sacrifice. The UK tax treatment for RSUs is similar to how your salary is taxed.

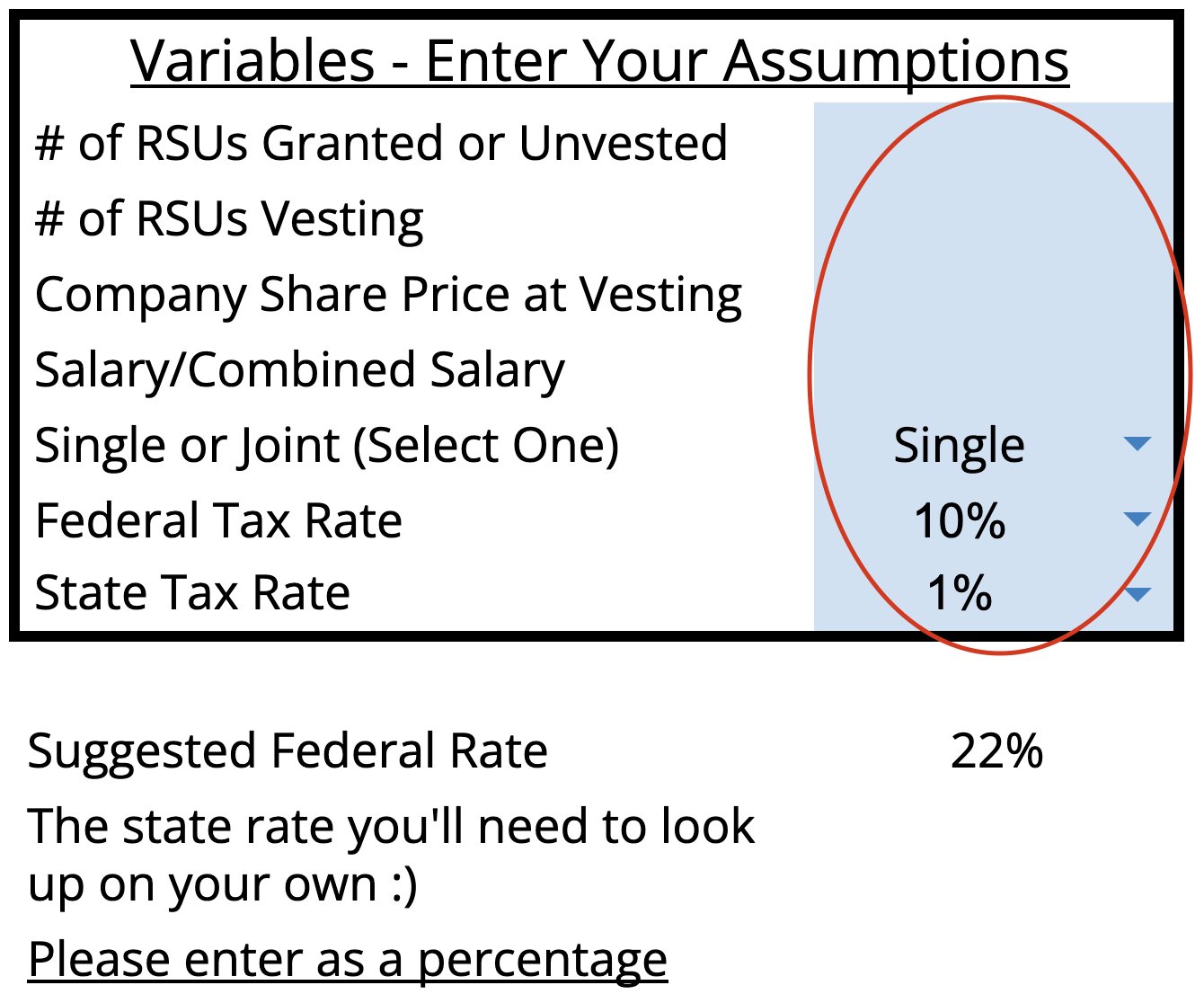

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rewarding Talent Country By Country Review Which Countries Are Favourable For Stock Options Index Ventures

Employee Stock Options Canadian Employees Tax Implications

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Rewarding Talent Country By Country Review Which Countries Are Favourable For Stock Options Index Ventures

The True Value Of Stock In A Company Like Wise Wise Careers

Liquid Rsus A New Equity Paradigm For Private Companies Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

/GettyImages-1302423098-49b33019619b46e599f2c4627b3f3843.jpg)

Get The Most Out Of Employee Stock Options

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Lithuania In 2020 Changes Coming For Employee Stock Kpmg Global

Staking Crypto Is It Tax Free Europe Youtube

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Tax Deductions For Employer Owned Stocks Rsus Stock Options Espps Turbotax Tax Tips Videos

What Is A Typical Sign On And Rsu Grant Offer For A New Level 6 Amazon Manager Quora